As we mentioned before a sole proprietorship makes up the majority of small businesses in the US. Typically choosing a business entity comes down to three considerations.

Benefits Considerations And Risks Of An Incorporation Cleaning Business Crowdfunding Business

You Could Use A Fresh Legal Perspective.

. 76 of legal departments surveyed reported having five or fewer employees focused on entity management. A law firm can be wide-ranging clients from individuals to banks too big companies. Finally think about the level of control that each legal entity offers business owners.

Being able to depreciate the value of the building is only as good as the ability of the business owner to have that deduction offset other income. A legal entity is any company or organization that has legal rights and responsibilities including tax filings. Its always advisable to have a legal document detailing the responsibilities of each partner both physical and monetary.

Because sole proprietorships are so easy to set up. Normally this is limited by the business owners basis in the property which is the actual amount of money that they put into the business. An efficient structure creates value for its public or private owners provides clarity for its employees and reduces the overall cost structure.

Lets take a closer look at each one and talk about some of the advantages and disadvantages of. Your businesss legal structure determines your tax rates management and paperwork. Asset protection estate planning and tax issues.

LEI records contain valuable accurate and transparent identity data attributes. Unlock the Tax Benefits of a Legal Entity Review. Like an LLC the members of a co-op have limited liability for the legal and financial debts and obligations of the business.

The basic premise is that the business is carried out in the sole owners name meaning that the owner has total control over business operations. When it comes to choosing a business entity type there are five common choices you can pick from. An organizations legal entity structure should link its tax efficiency business purpose strategic direction and operational effectiveness.

In this case a partnership is your best option. Legal entity management tends to be a shared responsibility between legal tax and finance departments. Ideas resources advice support tools strategies real stories and real business examples.

The best way to power all of the above and to make the most of legal entity reporting best practices is to create a single source of truth for all entity information. Co-ops do not tax their individual members on. To complete Assignment 1 write a four to five 4-5 page paper in which you do the following.

Successfully start grow innovate and lead your business today. More on that in another post. And there are three main types of business entities to.

The render various types of services primary being legal consultation and legal assistance. A cooperative co-op is a business entity that is owned by the same people that it serves. A law firm is a business entity that practices law.

Whether youre just starting out or your business is growing its crucial to understand the options. There are four types of partnerships. LEIs are the primary connector between all the regional and private sector organization identifiers.

There are typically three reasons why the management of legal entities is a cause of concern for legal finance and tax leaders. Both humans and machines can verify the LEI. Bothall parties share equally in the investment the profitability the management and the liability of the.

Compare and contrast the tax rules and treatment applicable to those three forms of organization and the major way in which the tax treatment affects the shareholders or partners. Review the various public information protocols for each legal entity so you can choose the best option for your business. Entrepreneur notes that a sole proprietorship isnt a legal entity just an individual who runs a business and takes full responsibility for its debts and liabilities.

Owning a business could cause one to view a legal document through the lens of profit loss marketing or other competing factors. Tracking Tracking Tracking Having a corporate entity is the best way to keep your personal and business interests accounts money and identity. Some business sales involve on the purchase of the companys assets.

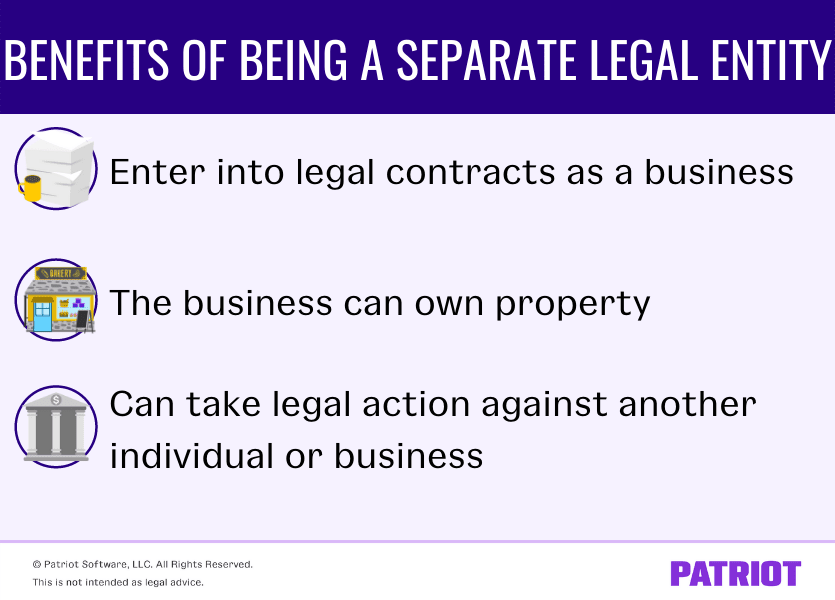

This process of consultation and assistance is about informing the clients their rights duties violations legal. It is a business that can enter into contracts either as a vendor or a supplier and can sue or be sued in a court of law. Its members or owners decide on the organizations mission direction and profits.

Explain at least two reasons why a business owner might opt for one. Even if the business has never had outside investors you still may want to sell it someday. Thus entrepreneurs looking to maintain a high level of confidentiality should not choose a corporation structure.

Missing LEIs cause disruptions in business activities deals and transactions. By housing the corporate record in a central repository one that is accessible to all stakeholders from wherever they are in the world organizations can help to mitigate. A sole proprietorship is the most common type of entity.

Legal entities are structured in a way that allows for a greater degree of protection for strictly personal. If you are running the business on your own a sole proprietorship is the simplest form of legal entity to set up.

4 Most Common Business Legal Structures Pathway Lending

What Is A Separate Legal Entity Definitions Examples More

Business Sherpa What Type Of Business Entity Should You Form Law School Prep Law School Humor Business Law

The Best Review Of Property Law Act Qld Acting Business Law Conflict Resolution

0 Comments